Average Rent to Income Ratio Statistics For 2023

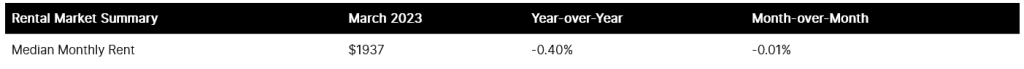

- First yearly rent decrease in 36 months in March 2023

- Rent decline of almost 0.5% in March 2023

- Six months of single-digit rent increases prior.

- Double-digit rent increases from October 2020 to September 2021

- Rent levels at $1,937 in both February and March 2023

- Smallest decline (-0.01%) since September 2022 moderation

- Rent prices fell in 6 of the last seven months, averaging nearly a 1% drop each month.

- November exception: 1.23% rent increase

- Lowest rent price since February 2022 ($1,904)

- Rent price peak in August 2022: $2,053

- Yearly rent growth turned negative in March 2023 (-0.40%)

- March 2023 marks the first negative yearly growth since March 2020

- Monthly rent changes dipped 0.01% from February to March 2023

- Rent prices decreased in 4 of the last four months and 6 of the last seven months.

- The national median rent in March 2023: $1,937 (unchanged from February)

- Lowest median rent since February 2022 ($1,904)

- Rent price peak in August 2022: $2,053

- Prices are down 5.63% since the August 2022 peak.

- Rent growth since March 2021: 17.11%, annual growth rate: 8.56%

- Monthly rent increase since March 2021: $283

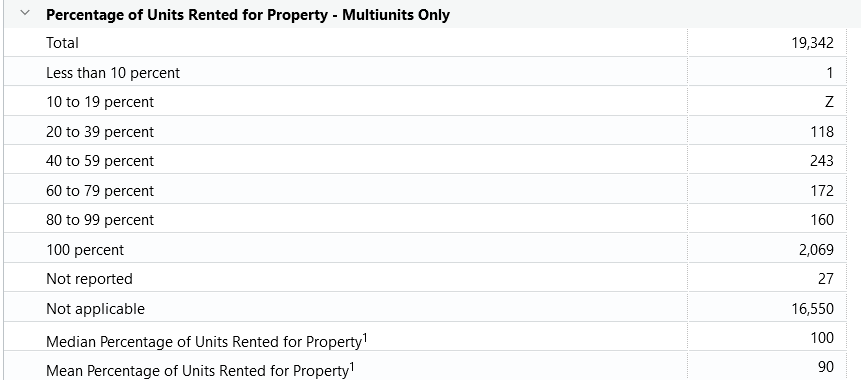

- Factors contributing to price slowdown: increased vacancy rates, new inventory, cooling housing market, and below-average demand

Rent to Income Ratio: A Comprehensive Guide

Are you planning to rent a new apartment or house? If so, you need to know about the rent-to-income ratio. It is a crucial metric to consider when renting a property, as it determines how much of your income will end up being spent on rent. This comprehensive guide will explain the rent-to-income ratio, how to calculate it, and why this matters. So, let’s dive in.

Introduction

The rent-to-income ratio is a calculation that helps renters determine how much of their income will be spent on rent. This ratio is essential as it ensures that renters don’t overspend on rent and can still afford their other expenses. The ideal rent-to-income ratio is 30% or less, but it varies depending on the location and income level of the renter.

Here are some of the determining factors that can affect the rent-to-income ratio:

- Location: Properties in prime areas tend to have a higher rent-to-income ratio.

- Income Level: A higher income level allows for a higher rent-to-income ratio.

- Credit Score: A high credit score will help renters negotiate a lower rent-to-income ratio.

- Debt-to-Income Ratio: A lower debt-to-income ratio can also help renters negotiate a lower rent-to-income ratio.

Now, we’ll take a closer look at how to calculate the rent-to-income ratio.

How to Calculate Rent to Income Ratio

Calculating the rent-to-income ratio is simple. Here’s how to do it:

Step 1: Calculate your monthly income

Start by calculating your monthly income. This includes your salary, any bonuses or commissions, and any other sources of income you may have.

Step 2: Calculate your monthly rent

Next, calculate your monthly rent. This includes your base rent and any additional fees, such as parking, utilities, and maintenance.

Step 3: Divide your monthly rent by your monthly income

Finally, divide your monthly rent by your monthly income. The resulting number is your rent-to-income ratio. For example, if your monthly rent is $1,500 and your monthly income is $5,000, your rent-to-income ratio is 30%.

It’s essential to remember that the rent-to-income ratio should be 30% or less. If it’s higher than that, you may have trouble affording other expenses, such as food, transportation, and savings.

Why Rent to Income Ratio Matters

The rent-to-income ratio matters as it determines how much of your income you will be spending on rent. If your rent-to-income ratio is too high, you may be unable to afford other essential expenses, such as food, transportation, and savings. This can lead to financial stress and make it challenging to save for the future.

On the other hand, if your rent-to-income ratio is too low, you may be overspending on rent and not saving enough for emergencies and future investments.

Therefore, finding the right balance is crucial and ensuring that your rent-to-income ratio is not too high or too low.

The Ideal Rent to Income Ratio

As mentioned earlier, the ideal rent-to-income ratio is 30% or less. However, this ratio varies depending on the location and income level of the renter. For example, if you live in a prime location like New York City or San Francisco, your rent-to-income ratio may be higher than 30%. Your rent-to-income ratio may be lower than 30% if you have a lower income level.

Consider your income, location, and other expenses to find the ideal rent-to-income ratio for your situation. You may have to make adjustments to your budget to find the right balance and ensure that you can afford your rent and still save for the future.

How Rent to Income Ratio Affects Rental Applications

The rent-to-income ratio is also essential when applying for a rental property. Landlords and property managers often require renters to have a specific rent-to-income ratio to ensure they can afford the rent and other expenses.

If your rent-to-income ratio is too high, you may be denied a rental application, even if you have an excellent credit score and rental history. Therefore, it’s essential to calculate your rent-to-income ratio before applying for a rental property and ensure that it meets the requirements.

FAQs about Rent to Income Ratio

What is an excellent rent-to-income ratio?

A good rent-to-income ratio is 30% or less. However, this ratio can vary depending on the location and income level of the renter.

Why is the rent-to-income ratio important?

The rent-to-income ratio is crucial as it determines how much of your income you will be spending on rent. If the ratio is too high, you may be unable to afford other essential expenses, such as food, transportation, and savings.

Can I negotiate the rent-to-income ratio with my landlord?

Yes, you can negotiate the rent-to-income ratio with your landlord. However, having a good credit score and rental history is essential to increase your chances of success.

How does the rent-to-income ratio affect my credit score?

The rent-to-income ratio does not directly affect your credit score. However, if you have a high rent-to-income ratio, you may have trouble paying your other bills on time, which can negatively affect your credit score.

How can I lower my rent-to-income ratio?

You can lower your rent-to-income ratio by finding a cheaper rental property, increasing your income, or reducing your expenses.

Is it better to have a lower or higher rent-to-income ratio?

It’s better to have a lower rent-to-income ratio as it ensures you can afford other essential expenses and save for the future.

Why are Rent Prices Increasing?

Rent prices are increasing due to various factors, including:

- Supply and demand: When there is a high demand for rental properties and the supply is low, landlords can increase rent prices as they know renters will still pay for the property.

- Inflation: Inflation causes the cost of living to increase, which can lead to rent prices increasing as well.

- Property taxes: Property taxes can increase, leading landlords to increase rent prices to cover the additional cost.

- Maintenance and repair costs: When landlords need to make repairs or maintain their properties, it can lead to increased costs, which can then be passed on to renters through increased rent prices.

- Location: Rent prices can vary depending on the location of the property. Properties in prime locations, such as near the city center or popular neighborhoods, tend to have higher rent prices.

- Economic growth: As the economy grows, incomes tend to increase, which can lead to landlords increasing rent prices to take advantage of renters’ increased ability to pay.

It’s essential to keep in mind that rent prices can fluctuate depending on these and other factors. Renters should stay informed about the rental market and be prepared to negotiate with landlords to find a fair rent price.

- https://www.rent.com/research/average-rent-price-report/

- https://www.businessinsider.com/us-cities-average-rents-higher-than-what-renters-can-afford-2022-3

- https://www.cnbc.com/2022/09/28/how-to-make-buy-vs-rent-housing-decision-as-mortgage-rates-surge.html

- https://www.newsweek.com/thanks-short-term-investors-ill-probably-never-own-home-opinion-1727754

- https://www.realestatewitch.com/rent-to-income-ratio-2022/